In this article, you will learn about the best budget travel insurance options that will help you protect your trip and save money at the same time. We will discuss the importance of travel insurance, particularly for those with a limited budget. By exploring different options, you will discover how to find affordable coverage that suits your needs. So, let’s dive in and learn how to safeguard your travel adventures without breaking the bank!

Discover the Best Budget Travel Insurance Options: Protect and Save!

Are you planning your next adventure but worried about unpredictable incidents that may occur along the way? Look no further – budget travel insurance is here to safeguard your journey without burning a hole in your pocket. In this comprehensive guide, we will explore the definition, importance, benefits, types, and top companies offering budget travel insurance. We will also discuss factors to consider, tips for saving money, common misconceptions, and the claim process. So buckle up, and let’s embark on a journey to discover the best budget travel insurance options that can protect and save you from financial uncertainty.

What is budget travel insurance?

Definition of budget travel insurance

Before we delve deeper into the subject, it is essential to understand the concept of budget travel insurance. Budget travel insurance, as the name suggests, is an affordable and cost-effective insurance policy designed specifically for travelers who want to protect themselves and their belongings without breaking the bank. It offers coverage for medical emergencies, trip cancellations, lost or stolen belongings, and emergency assistance services, all within a reasonable budget.

Importance of budget travel insurance

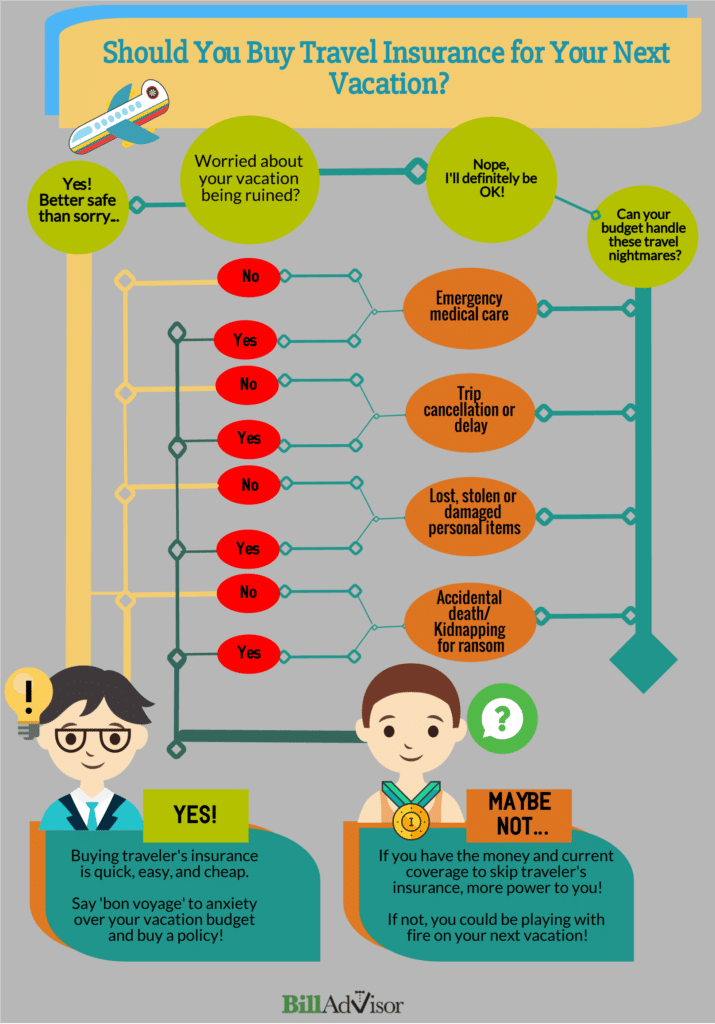

Traveling is an exciting experience, but it can also be fraught with risks. From unforeseen medical emergencies to trip cancellations, a single mishap can disrupt your plans and leave you facing hefty financial burdens. Budget travel insurance acts as a safety net, providing you with financial protection and peace of mind throughout your journey. By investing in a budget travel insurance policy, you can mitigate these risks and enjoy your trip knowing that you are covered.

Benefits of budget travel insurance

Coverage for medical emergencies

One of the primary benefits of budget travel insurance is coverage for medical emergencies. Falling ill or getting injured during your trip can lead to exorbitant medical expenses. However, with budget travel insurance, you can rest assured that your medical bills will be taken care of, allowing you to receive the necessary treatment without worrying about the financial burden.

Protection against trip cancellations

Another significant benefit of budget travel insurance is protection against trip cancellations. Life is unpredictable, and sometimes circumstances may arise that force you to cancel or cut short your trip. Budget travel insurance provides reimbursement for non-refundable expenses such as flights, hotels, and tour bookings, ensuring that you don’t bear the brunt of financial losses resulting from unforeseen events.

Reimbursement for lost or stolen belongings

Losing your belongings or having them stolen can put a damper on your travel experience. Budget travel insurance offers coverage for lost or stolen belongings, including luggage, personal items, and important documents such as passports and visas. With this coverage, you can receive reimbursement for the value of your lost items, allowing you to replace them and continue your journey without hassle.

Emergency assistance services

In times of distress, having access to emergency assistance services can be a lifesaver. Budget travel insurance provides round-the-clock emergency assistance, giving you access to a helpline that can assist you with medical emergencies, legal aid, and travel-related information. Whether you need medical referrals or assistance with lost travel documents, the emergency assistance services provided by budget travel insurance can help you navigate any unforeseen hurdles during your trip.

Factors to consider when choosing budget travel insurance

Selecting the right budget travel insurance policy can be overwhelming with the myriad of options available in the market. To make an informed decision, it is essential to consider the following factors:

Coverage limits and exclusions

When comparing different budget travel insurance policies, pay close attention to their coverage limits and exclusions. Ensure that the policy offers adequate coverage for medical expenses, trip cancellations, and lost or stolen belongings. Additionally, be aware of any exclusions that may limit or restrict your coverage, such as pre-existing medical conditions or high-risk activities.

Premium and deductible

The premium, or the amount you pay for the insurance policy, and the deductible, or the amount you have to pay out of pocket before the insurance coverage kicks in, are crucial factors to consider. While budget travel insurance is designed to be affordable, it is essential to strike a balance between the premium and deductible to ensure that you are adequately covered without straining your finances.

Policy terms and conditions

Take the time to read and understand the policy’s terms and conditions before making a decision. Pay attention to details such as the policy duration, geographical coverage, and any additional benefits or features offered. Familiarize yourself with the claims process, including the necessary documentation and timeframes for filing a claim. Being aware of the policy’s terms and conditions will help you make an informed decision and avoid any surprises in the future.

Customer reviews and ratings

Lastly, consider the experiences and feedback of other travelers by reading customer reviews and ratings of different budget travel insurance companies. Reviews can provide valuable insights into the quality of coverage, customer service, and claim resolution process. Opt for insurance providers with positive reviews and high ratings to ensure a smooth and hassle-free experience.

Types of budget travel insurance

Budget travel insurance comes in various forms to cater to the diverse needs of travelers. Some common types of budget travel insurance include:

Single trip insurance

Single trip insurance provides coverage for a single journey, typically ranging from a few days to a few months. It is ideal for travelers embarking on a one-time trip and offers comprehensive coverage for medical emergencies, trip cancellations, and lost or stolen belongings.

Annual multi-trip insurance

Annual multi-trip insurance is designed for frequent travelers who embark on multiple trips within a year. With this type of insurance, you are covered for an unlimited number of trips throughout the year, as long as each trip does not exceed a specified duration. It provides the convenience of continuous coverage and is a cost-effective choice for individuals who travel frequently.

Family travel insurance

Family travel insurance offers coverage for the entire family unit, including the policyholder, their spouse or partner, and dependent children. It provides protection for medical emergencies, trip cancellations, and lost or stolen belongings for every member of the family, ensuring that you can travel with peace of mind.

Group travel insurance

Group travel insurance is designed for groups of travelers, such as friends, colleagues, or sports teams, who are traveling together. It provides coverage for medical emergencies, trip cancellations, and lost or stolen belongings for each member of the group. Group travel insurance offers convenience and cost savings compared to purchasing individual policies for each group member.

Top budget travel insurance companies

Now that we have explored the benefits and types of budget travel insurance, let’s take a look at some of the top companies offering reliable and affordable coverage:

Company A

Company A is known for its comprehensive coverage and excellent customer service. They offer affordable budget travel insurance policies that cater to a wide range of travelers, from solo adventurers to families.

Company B

Company B prides itself on providing cost-effective solutions without compromising on coverage. With their budget travel insurance policies, you can enjoy peace of mind while exploring new destinations.

Company C

Company C is renowned for its fast and efficient claim settlement process. They provide budget travel insurance policies that offer extensive coverage and value for money.

Company D

Company D stands out for its customizable budget travel insurance policies. They understand that every traveler is unique, and their policies can be tailored to suit individual needs and preferences.

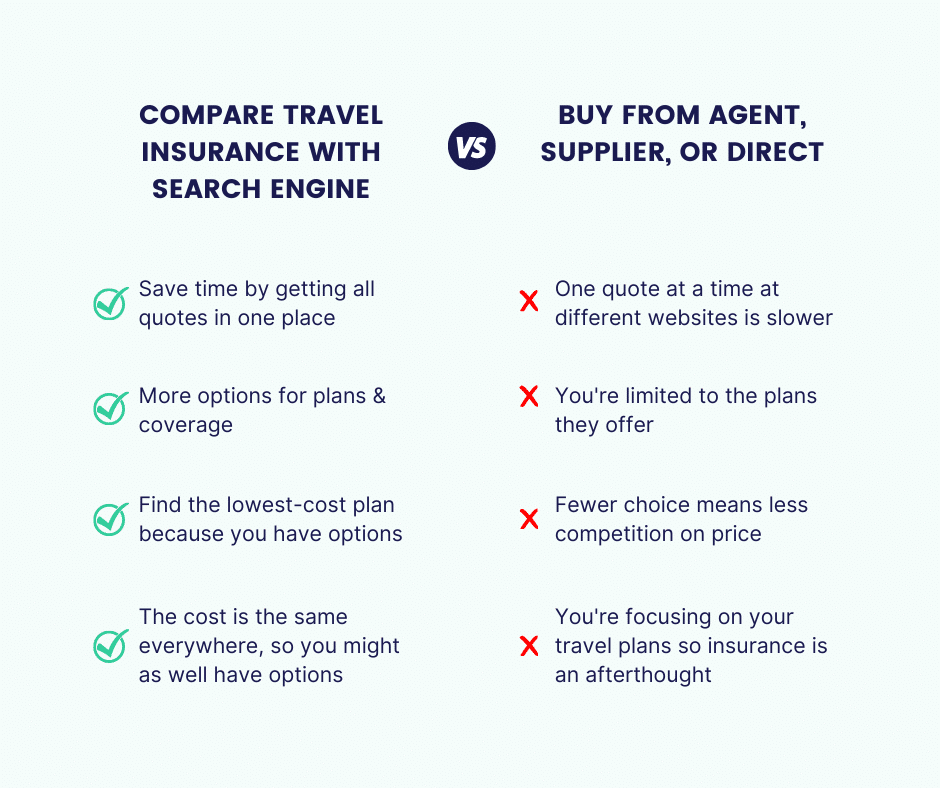

Comparison of budget travel insurance options

With numerous budget travel insurance options available, it can be challenging to choose the one that best suits your needs. To simplify the decision-making process, consider the following factors when comparing different options:

Coverage

Evaluate the coverage provided by each budget travel insurance policy. Consider what risks are most relevant to your trip and ensure the policy offers suitable coverage for medical emergencies, trip cancellations, and lost or stolen belongings.

Price

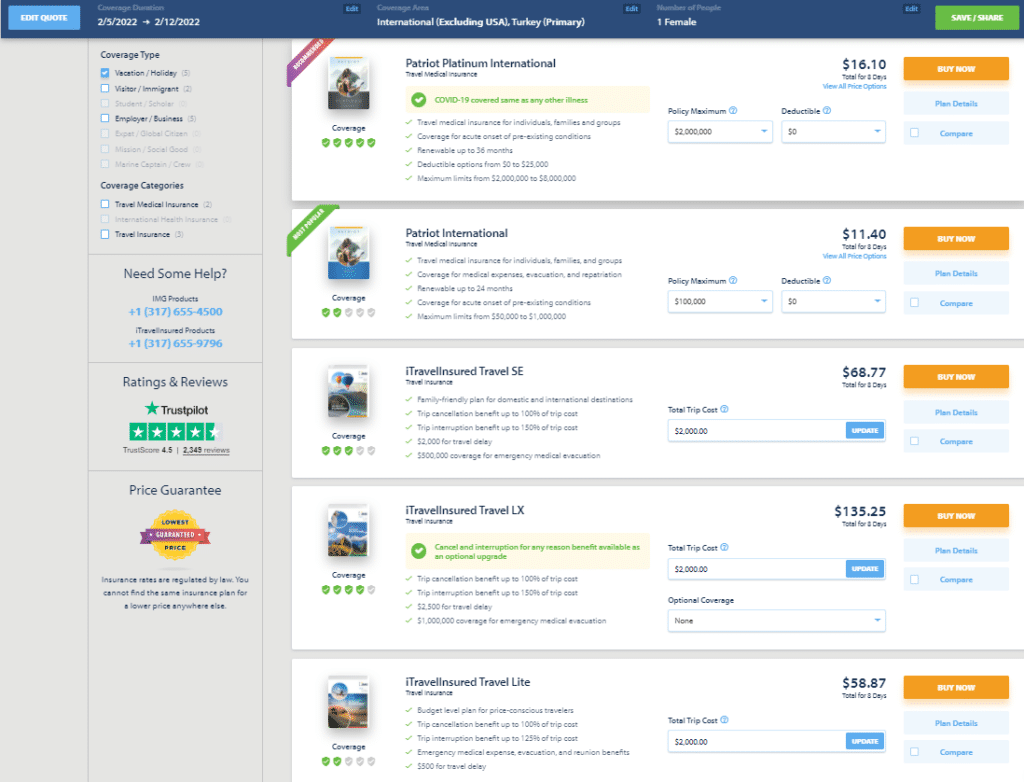

Compare the premiums of different budget travel insurance policies, keeping in mind factors such as deductible and coverage limits. Look for policies that strike a balance between affordability and adequate coverage.

Customer reviews

Read customer reviews and ratings to gauge the experiences of other travelers with the budget travel insurance companies you are considering. Positive reviews and high ratings are indicative of a reliable and trustworthy insurance provider.

Additional benefits

Consider any additional benefits or features offered by the budget travel insurance policies. These could include emergency assistance services, coverage for high-risk activities, or access to travel-related information and resources.

Tips for saving on budget travel insurance

Now that we have covered the benefits, types, and top companies offering budget travel insurance, let’s explore some valuable tips for saving money on your policy:

Shop around for the best deals

Don’t settle for the first budget travel insurance policy you come across. Take the time to shop around and compare different options. Look for reputable insurance providers and request quotes to compare premiums, coverage limits, and deductibles. Shopping around ensures that you get the best value for your money.

Consider bundled insurance packages

If you already have other insurance policies, such as health or home insurance, consider bundling them with your budget travel insurance. Many insurance companies offer discounted rates for bundled packages, allowing you to save money on multiple policies.

Opt for higher deductibles

Choosing a policy with a higher deductible can significantly reduce your premium. However, keep in mind that you will need to pay a higher out-of-pocket amount before the coverage kicks in. Assess your risk tolerance and financial capability before opting for a higher deductible.

Take advantage of discounts and promotions

Insurance companies often offer discounts and promotions that can help you save money on your budget travel insurance. Keep an eye out for these opportunities and take advantage of them when available. Common discounts include loyalty discounts for existing customers or promotional discounts for new policyholders.

Common misconceptions about budget travel insurance

Despite its undeniable benefits, there are several misconceptions surrounding budget travel insurance. Let’s debunk some of these myths:

It is not reliable

Some travelers believe that budget travel insurance is not reliable due to its affordability. However, reputable insurance providers offer budget travel insurance policies that provide reliable coverage and excellent customer service. It is crucial to choose a reputable company that has a track record of delivering on their promises.

It does not provide sufficient coverage

Another common misconception is that budget travel insurance does not provide sufficient coverage. While budget travel insurance may have certain limitations compared to more comprehensive policies, it still offers essential coverage for medical emergencies, trip cancellations, and lost or stolen belongings. By carefully assessing your needs and selecting the right policy, you can ensure that you are adequately covered.

It is only for frequent travelers

Some travelers believe that budget travel insurance is only suitable for frequent travelers. However, budget travel insurance is designed to cater to all types of travelers, including those embarking on a single trip or occasional journeys. Whether you are a frequent traveler or a once-in-a-lifetime adventurer, budget travel insurance can provide the coverage you need at an affordable price.

Steps to buy budget travel insurance

Now that you are equipped with the necessary knowledge about budget travel insurance, let’s walk through the steps to purchase your policy:

Research and compare policies

Start by researching and comparing different budget travel insurance policies. Consider factors such as coverage, price, and customer reviews to shortlist a few options that suit your needs.

Obtain quotes

Contact the insurance companies or use their online portals to obtain quotes for the shortlisted policies. Provide accurate information about your trip and personal details to get accurate quotes.

Read the policy documents thoroughly

Once you receive the quotes, take the time to read the policy documents thoroughly. Pay attention to coverage details, exclusions, terms and conditions, and claim procedures. If you have any questions or concerns, reach out to the insurance company for clarification.

Make the purchase

Once you have selected the policy that best meets your requirements, proceed to make the purchase. Follow the instructions provided by the insurance company to complete the necessary paperwork and payment.

Understanding the claim process for budget travel insurance

While we hope that you never have to make a claim, it is crucial to understand the claim process in case you encounter any unforeseen incidents during your trip. Here is a step-by-step guide to the claim process for budget travel insurance:

Reporting the incident

In the event of a medical emergency, trip cancellation, or loss of belongings, contact the insurance company’s claim hotline immediately. Provide them with the necessary information and follow their instructions for proceeding with the claim.

Submitting necessary documents

Prepare and submit all the necessary documents to support your claim. These may include medical reports, police reports, receipts for lost or stolen items, and any other supporting documentation as required by the insurance company.

Claim assessment

The insurance company will assess your claim based on the information and documents provided. They may request additional information or conduct further investigations, if necessary.

Disbursement of claim amount

If your claim is approved, the insurance company will disburse the claim amount to you as per the terms and conditions of the policy. The disbursement method may vary, so ensure that you provide accurate and up-to-date information for smooth processing.

Importance of reading the policy fine print

When purchasing any insurance policy, including budget travel insurance, it is essential to read the fine print. Here’s why:

Understanding coverage limitations

The fine print of the policy outlines the coverage limitations and exclusions. By reading it thoroughly, you can understand what risks are covered and what situations may lead to a denial of your claim. Knowing the coverage limitations will help you manage your expectations and make informed decisions during your trip.

Knowing claim procedures

The policy’s fine print provides information about the claim procedures and requirements. Understanding the claim process ensures that you are prepared in case you need to make a claim. By familiarizing yourself with the claim procedures beforehand, you can save time and avoid potential pitfalls during the claims process.

Recognizing exclusions and restrictions

The policy’s fine print also highlights any exclusions or restrictions that may limit or restrict your coverage. These may include pre-existing medical conditions, specific high-risk activities, or travel to certain countries. Being aware of these exclusions and restrictions will help you plan your trip accordingly and avoid situations that may lead to a denial of your claim.

Being aware of policy duration

The fine print specifies the duration of the policy and any limitations on trip length. Understanding the policy’s duration is crucial to ensure that you are covered for the entire duration of your trip. Be mindful of any restrictions on trip length to avoid invalidating your coverage.

How to make the most of your budget travel insurance

Now that you have purchased your budget travel insurance policy, here are some tips to make the most of your coverage:

Keep your insurance documents handy

Ensure that you have a copy of your insurance policy, along with the emergency assistance hotline number and any necessary claim forms, easily accessible during your trip. This will allow you to quickly refer to the policy details and contact the insurance company if needed.

Contact the emergency assistance hotline

If you encounter any emergencies or require assistance during your trip, do not hesitate to contact the 24/7 emergency assistance hotline provided by your insurance company. They can guide you through the necessary steps and provide immediate support and advice.

File timely claims

In case of any incidents that may lead to a claim, file your claim in a timely manner. Most insurance companies require claims to be filed within a specific timeframe, so ensure that you initiate the process as soon as possible to avoid any delays or potential denial of your claim.

Review and update your policy as needed

Throughout the duration of your policy, review and reassess your coverage needs regularly. If your travel plans change or you require additional coverage, contact the insurance company to update your policy accordingly. Keeping your policy up to date ensures that you are adequately covered for any new risks or circumstances that may arise.

Common mistakes to avoid when buying budget travel insurance

To make the most of your budget travel insurance, steer clear of these common mistakes:

Not assessing specific travel needs

It is essential to assess your specific travel needs before purchasing a budget travel insurance policy. Consider factors such as the destination, activities planned, and existing health conditions to ensure that the policy offers adequate coverage for your requirements.

Not disclosing pre-existing medical conditions

Honesty is crucial when disclosing your medical history to the insurance company. Failing to disclose pre-existing medical conditions may lead to a denial of your claim or invalidation of your coverage. Be transparent about your medical history to ensure that you are adequately covered.

Neglecting to compare different policies

Comparing different budget travel insurance policies is essential to find the one that offers the best value for your money. Neglecting to compare policies may result in paying higher premiums for lower coverage or missing out on additional benefits offered by other insurance providers.

Skipping reading the policy terms

Skipping the fine print and policy terms can lead to misunderstandings and surprises during your trip. Take the time to read and understand the policy terms to ensure that you are aware of the coverage limitations, claim procedures, and any exclusions or restrictions.

Conclusion

Budget travel insurance is a must-have for every traveler, as it provides financial protection and peace of mind during your journey. In this comprehensive guide, we have explored the definition, importance, benefits, types, and top companies offering budget travel insurance. We have also discussed factors to consider, tips for saving money, common misconceptions, and the claim process. By following the tips provided and making an informed decision, you can choose the best budget travel insurance option and save money while protecting yourself and your belongings. Remember to always read the policy fine print, avoid common mistakes, and make the most of your coverage. So embark on your next adventure with confidence, knowing that you have the best budget travel insurance to protect and save you from any unforeseen bumps along the way.